The Rs 412.62 crore Stove Kraft initial public offer (IPO) is set to open for subscription on Monday, January 25.

This will be the fourth public issue of the calendar year 2021, after the just-concluded Indian Railway Finance Corp IPO, and the ongoing Indigo Paints and Home First Finance Company India IPOs.

About Company

Stove Kraft Private Limited was incorporated on June 28, 1999, in Bangalore as a private limited company under the Companies Act, 1956.

Subsequently, the company was converted into a public limited company pursuant to a special resolution passed by our Shareholders at the extraordinary general meeting held on May 28, 2018.

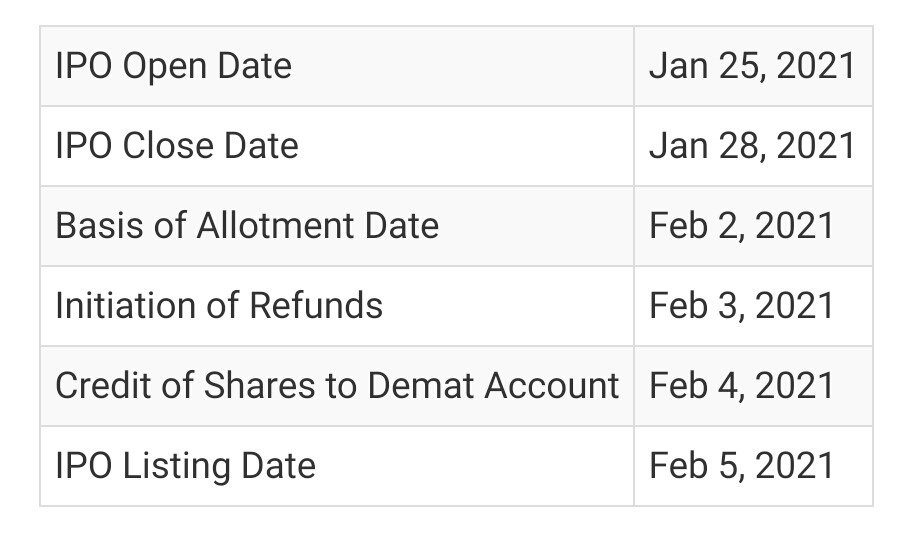

IPO Schedule

Price Band

The company has fixed a price band of ₹384 to ₹385 per equity share.

IPO Composition

Stove Kraft IPO consists of fresh issue of shares worth Rs 95 crore and an offer-for-sale (OFS) of 82.50 lakh shares by investors and promoters.

The offer for sale comprises up to 6,90,700 shares by promoter Rajendra Gandhi; up to 59,300 shares by promoter Sunita Rajendra Gandhi; up to 14,92,080 shares by Sequoia Capital India Growth Investment Holdings and up to 6,007,920 shares by SCI Growth Investments II.

The promoters Rajendra Gandhi and Sunit Rajendra Gandhi hold 1,84,43,919 shares amounting to 61.31% of the company pre-offer.

Lot Size

Retail investors can bid for Stove Kraft shares in lot size of 38 shares

Intermediaries

The book running lead managers to the offer are Edelweiss Financial Services and JM Financial.

While KFin Technologies Private Ltd will be the registrar to the issue.

Fund Utilisation

The net proceeds from IPO will be used to retire debt which is around Rs 76 crore and general purposes.

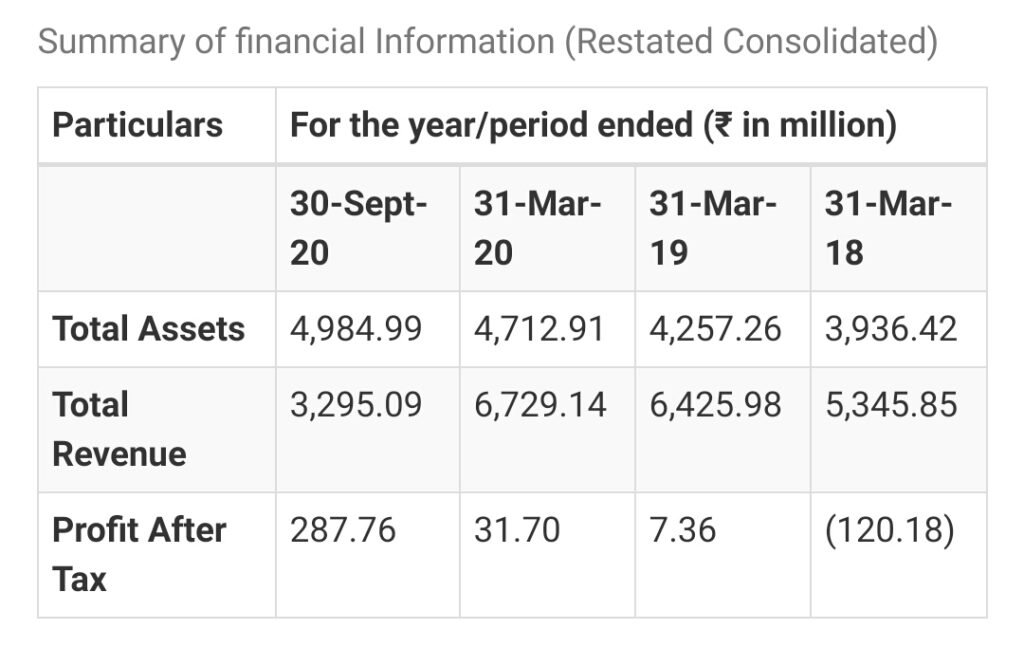

Company’s Financial

Press the Bell Icon for notifications of all updates