Agrichemicals manufacturer Heranba Industries’ Rs 625-crore initial public offering (IPO) will open for subscription on Tuesday, February 23, 2021 and the subscription for anchor investors will open on February 22, 2021.

About Company

Heranba Industries’ public health products include general insect control, termiticide, larvicide, indoor residual spray, rodenticide and cockroach gels which are Formulations of synthetic pyrethroids.

The agrochemical firm is one of leading domestic producers of synthetic pyrethroids like cypermethrin, alphacypermethrin, deltamethrin, permethrin, lambda-cyhalothrin, etc.

Anish Moonka, Head of Research, JST Investments, told Financial Express Online that the sheer number of competitors (10+) with significant market share showcases a lack of any pricing power.

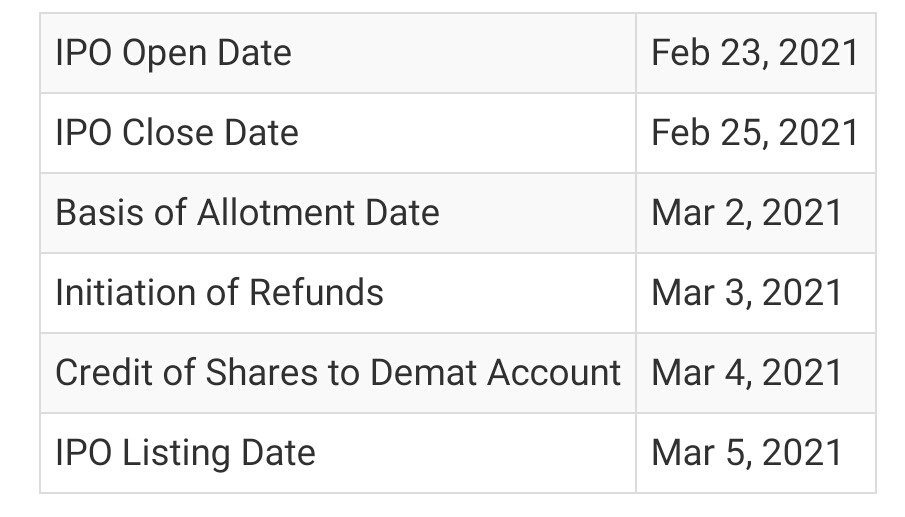

Important Dates

Price Band

The company has set the price band in the range of Rs 626 to Rs 627.

Lot Size

The Heranba Industries IPO market lot size is 23 shares. A retail-individual investor can apply for up to 13 lots (299 shares or ₹187,473).

IPO Composition

The public issue, which consists of a fresh issue of Rs 60 crore and an offer for sale of 90.15 lakh equity shares by promoters, will close on February 25.

The offer for sale consists of 58,50,000 equity shares by Sadashiv K Shetty, 22,72,038 shares by Raghuram K Shetty, 8,12,962 shares by Sams Industries, 40,000 shares by Babu K Shetty and 40,000 shares by Vittala K Bhandary.

Promoters – Sadashiv K Shetty, Raghuram K Shetty, Babu K Shetty and Vittala K Bhandary, and promoter group held 98.85 percent stake in the company as of February 10 this year.

Reservation

Quota reserved for QIBs is 50 per cent, while the same for HNI investors is 15 per cent and 35 per cent for retail investors.

Grey Market

Heranba Industries shares were seen quoting a grey market premium of Rs 200 or 32 per cent over the IPO price of Rs 627 apiece.

Press the 🔔 Icon for notifications of all new updates