Singapore’s central bank tightened its monetary policy settings on Tuesday in its first out-of-cycle move in seven years, as global supply constraints and brisk economic demand elevate inflation pressures across the region.

The city-state’s trade-dependent economy is highly susceptible to swings in global inflation and the central bank’s sudden move comes as price pressures ring alarm bells for policymakers elsewhere in Asia.

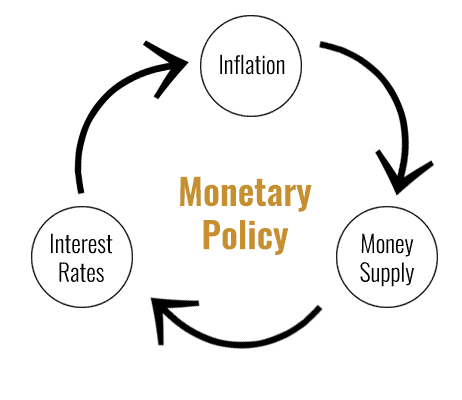

The Monetary Authority of Singapore (MAS), which manages monetary policy through exchange rate settings, said it would slightly raise the rate of appreciation of its policy band.

Similar Move

The Monetary Authority of Singapore last surprised with an off-cycle move in January 2015 when it eased its policy after a collapse in global oil prices.

Last year, many Asia-Pacific economies largely shrugged off inflationary threats that had rattled policymakers in Europe and the United States but that thinking now appears to be shifting.

“This move builds on the pre-emptive shift to an appreciating stance in October 2021 and is appropriate for ensuring medium-term price stability,” the MAS said, referring to its tightening move late last year.

Global Inflation

Australia’s core inflation flew to its fastest annual pace since 2014 in the December quarter, data showed on Tuesday, challenging the central bank’s benign interest rate outlook.

In Japan, a country renowned for its stubbornly tepid price growth, policymakers have also acknowledged creeping inflation pressures.

Singapore’s policy move comes just a day after data showed core inflation in the city-state climbed in December by the fastest pace in nearly eight years.

The Singapore dollar strengthened to 1.3425 versus the U.S. dollar, its highest since October 2021.

More about Singapore Economy

Singapore will release its annual budget on Feb. 18, when the government is expected to announce the timing for an anticipated hike in goods and services tax.

The city-state’s economy grew 7.2% in 2021, its fastest pace in over a decade, rebounding from a record 5.4% contraction in 2020. The government has spent more than S$100 billion over the last two years to cushion its economy from the impact of the pandemic.

Instead of interest rates, the MAS manages policy by letting the local dollar rise or fall against the currencies of its main trading partners within an undisclosed band.

It adjusts its policy via three levers: the slope, mid-point and width of the policy band.

Press the Bell icon for notifications of all new updates.