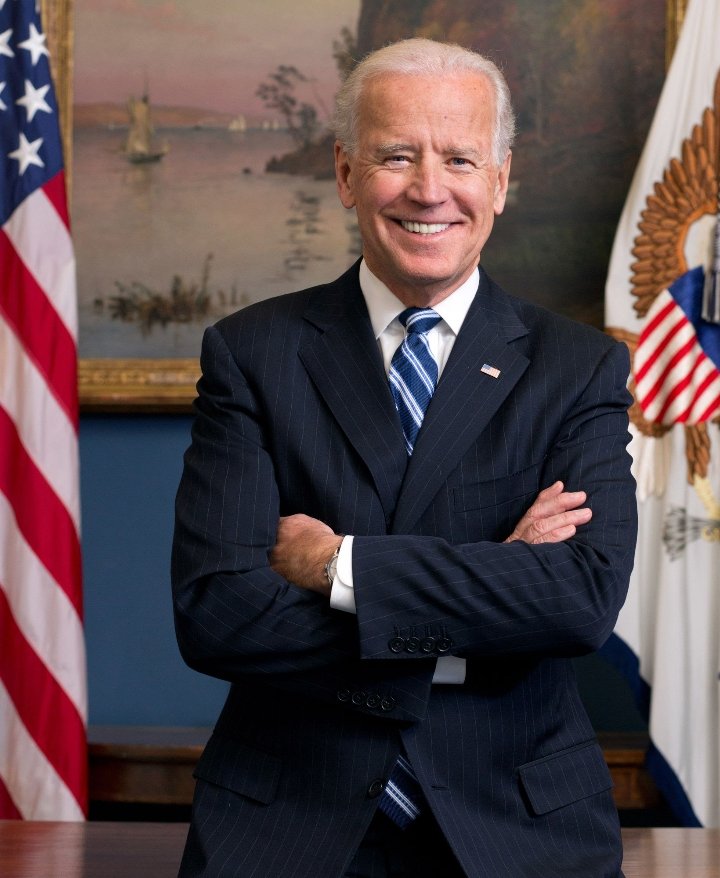

For borrowers making under $150,000 a year, Biden is considering forgiving $10,000 of their student loan debt. President Joe Biden canceled $1.5 billion of student loans through this program. He is expected to make his final decision in July or August, just before the student loan payment moratorium expires on August 31. However, lawmakers and supporters are doubtful all these activities can be completed in such a short timeframe because that date is less than two months away and there is no indication as to whether the delay will be extended.

Over the coming few months, a lot is on the line for millions of borrowers of federal student loans. Borrowers are anxiously awaiting announcements of any relief, from broad student loan forgiveness to restarting student loan payments after a two-year break.

Loan forgiven

Borrowers with student loans still have a chance to receive loan forgiveness through borrower defense against student loan repayment, even though Biden hasn’t implemented widespread student loan cancellation. Biden has now forgiven roughly $10 billion in student loans since taking office.

This includes the cancellation of $1.5 billion in student loans for 92,000 borrowers in accordance with the borrower defense to repayment law. Under the borrower’s defense to repayment, Biden revoked $55.6 million in student loans in July for more than 1,800 borrowers. You may be able to cancel all or a portion of your student loans using this Obama-era provision, which is still in effect today.

Borrowers of student loans have experienced a lot of uncertainty during the pandemic. Four times during his time as president, Biden has extended the suspension of student loan payments; however, these announcements were made just before the scheduled return of payments, leaving little time for borrowers to make financial preparations.

Organizations that helped this movement

Thanks in part to these individuals, student loans have been canceled. Additionally, there are a lot of non-profit organizations that have taken the initiative and fought for the rights of student loan borrowers, especially those who believe their college or university misled them. By relentlessly striving to ensure that student loan debtors receive a fair shake, these champion advocates are influencing the direction of student loans. The Project on Student Lending at Harvard Law School, Student Debt Crisis, and Student Borrower Protection Center are just a few of the organisations worth mentioning.

There are other projects for the department other than broad relief.

Although a payment pause extension and a general student debt forgiveness may currently be the two most important problems for student loan borrowers, the Education Department is concentrating on numerous other issues that might have a substantial impact on many borrowers.

For instance, the department last month announced changes to the Public Service Loan Forgiveness Program, which allows government and nonprofit employees to have their college loans forgiven after 10 years of eligible payments. A waiver that allows all earlier payments, including those deemed ineligible, to contribute toward forgiveness progress is included in those amendments and is valid through October 31.

Final thoughts