Brookfield India Real Estate Trust on Thursday said it is all set to raise Rs 3,800 crore through an initial public offering (IPO).

This will be the third REIT IPO in India after the successful listing of Blackstone Group Inc backed Mindspace Business Parks REIT last year and Embassy Office Parks REIT in 2019.

About Company

The company, backed by Canadian asset manager Brookfield Asset Management Inc, manages nearly $578 billion in assets globally.

The company has campus-format office parks strategically located in Mumbai, Noida, Gurugram, and Kolkata.

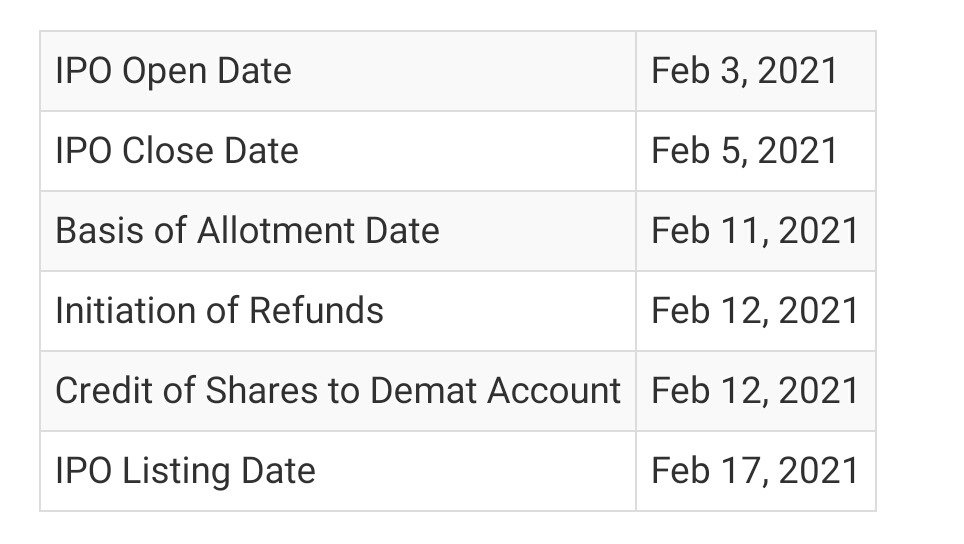

Important Dates

Issue Price

The Brookfield REIT will sell 138.2 million units to 138.5 million units at ₹274 to ₹275 each between February 3 and 5.

Face Value

The face value of the issue is Rs10

Lot Size

The Brookfield India REIT market lot size is 200 shares.

Fund utilisation

The company in its offer document said that the issue will be used for partial or full repayment of existing debt.

The company has a total debt of Rs 6,952.07 crore as of March 2020.

Company’s Financial

For the year/period ended (₹ in million)

| Particulars | 30-Sept-20 | 31-Mar-20 | 31-Mar-19 | 31-Mar-18 |

| Total Assets | 51,367.15 | 53,780.50 | 50,436.97 | 48,932.97 |

| Total Revenue | 4,674.66 | 9,813.95 | 9,298.30 | 8,662.51 |

| Profit After Tax | (739.22) | 151.22 | (157.45) | 1,610.84 |

Press the 🔔 Icon for notifications of all updates