Private equity firm Everstone Group promoted Burger King India Ltd on Friday said it is all set for the launch of its upcoming initial public offering (IPO)

Price Band

The company, after consultation with merchant bankers, has fixed IPO price band at Rs 59-60 per share, which is 5.9-6 times of its face value of equity shares.

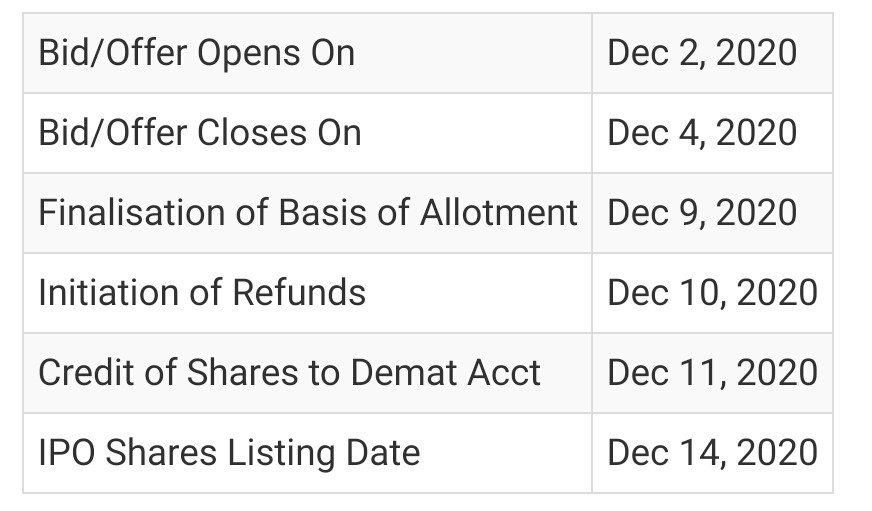

Subscription Date

Size of IPO

The Indian subsidiary of US-based Burger King aims to raise Rs 810 crore via its public issue, at a higher price band.

Lot Size

Bids can be made for a minimum of 250 equity shares and in multiples of 250 equity shares thereafter.

The maximum lot Size is 13 with 250 shares in each lot.

It means retail investors can apply for maximum up to 3,250 equity shares at higher price band.

IPO details

The IPO consists of a fresh issue of Rs 450 crore and an offer for sale of 6 crore equity shares by promoter QSR Asia Pte Ltd.

IPO Reservation

The company has reserved up to 10 percent portion of IPO for retail investors.

upto 15 percent for non institutional investors.

And up to 75 percent for qualified institutional investors.

Promoters Holdings

| Pre Issue Share Holding | 99.39% |

| Post Issue Share Holding | 65% |

Lead Managers

Kotak Mahindra Capital Company, CLSA India, Edelweiss Financial Services and JM Financial are the book running lead managers to the issue.

Fund Utilisation

Burger King India will use the funds to roll out of new company-owned Burger King Restaurants by way of – repayment or prepayment of outstanding borrowings of the company obtained for setting up of new company-owned Burger King Restaurants and capital expenditure incurred for setting up of new company-owned Burger King Restaurants, the company said in its red herring prospectus.

Pre IPO Funding

The company has also raised a pre-IPO funding of ₹92 crore from public markets investor Amansa Investments Ltd.

Shares were allotted to Amansa at a price of ₹58.5 per share.

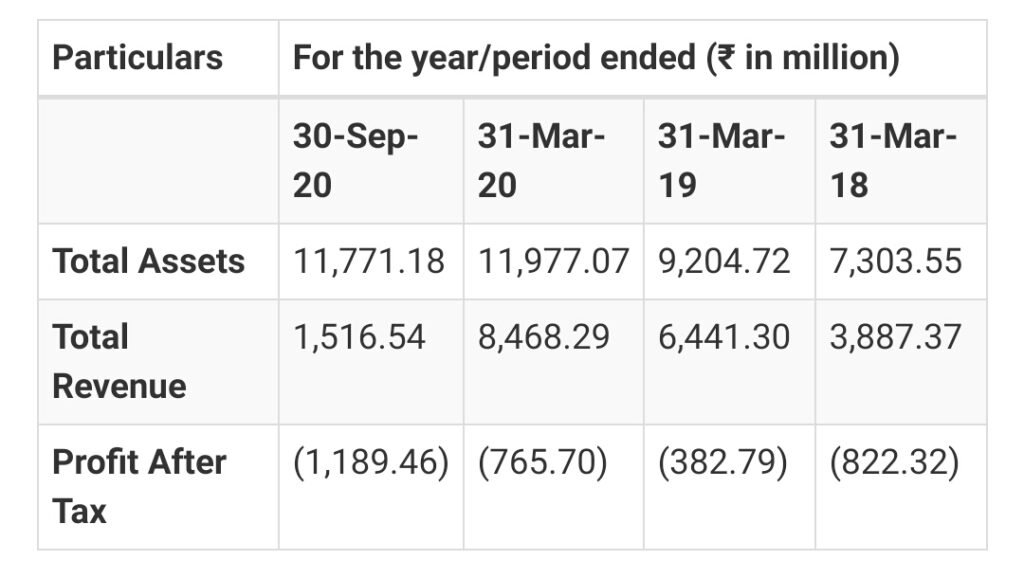

Company’s Performance

Press the Bell Icon for notifications of all updates