General Atlantic, a leading global growth equity firm has decided to invest ₹3,675 crore into Reliance Retail Ventures Ltd (RRVL), a subsidiary of Reliance Industries.

This marks the second investment by General Atlantic in a subsidiary of Reliance Industries, following a ₹ 6,598.38 crore investment in Jio Platforms announced earlier this year.

Reliance Retail has collected a combined ₹13,050 crore in the past few weeks

About Reliance Industries

Reliance is India’s biggest retailer with roughly 12,000 stores and has been looking to expand its so-called new e-commerce venture as it vies for market share in India’s growing retail space.

Earlier this month, Silver Lake and KKR & Co. had agreed to invest Rs 7,500 crore and Rs 5,550 crore, respectively, for a 1.75% and 1.28% stake in the retail holding arm.

Besides Silver Lake and KKR, General Atlantic had invested Rs 6,598 crore in Reliance’s telecom business.

About General Atlantic

General Atlantic (also known as “GA”) is an American growth equity firm providing capital and strategic support for global growth companies.

The firm was founded in 1980 as the captive investment team for Atlantic Philanthropies, a philanthropic organization founded by Charles F. Feeney, the billionaire co-founder of Duty Free Shoppers Ltd

As of June 30, 2020, General Atlantic has approximately $38.3 billion in assets under management

Shares acquired by General Atlantic’s

The global growth equity firm will pick up a 0.84% stake in Reliance Retail Ventures Ltd., the holding arm for Mukesh Ambani’s retail business

Price per share

The transaction is priced at Rs 682.25 apiece, same at which Reliance Retail Ventures issued shares to parent Reliance Industries through a private placement

Equity valuation of RRVL

The deal pegs the pre-investment equity valuation of Reliance Retail at Rs 4.28 lakh crore.

Current holding of Reliance

It has reported a consolidated turnover of Rs 1,62,936 crore ($21.7 billion) and net profit of Rs 5,448 crore ($726.4 million) for the year ended March 31, 2020.

Intermediaries

Financial & Legal Advisor of RIL

Morgan Stanley was the financial advisor to Reliance Retail.

Cyril Amarchand Mangaldas and Davis Polk & Wardwell served as the legal Advisors.

Legal Advisors of GA

Shardul Amarchand Mangaldas & Co and Paul, Weiss, Rifkind, Wharton & Garrison LLP are the legal counsel to General Atlantic.

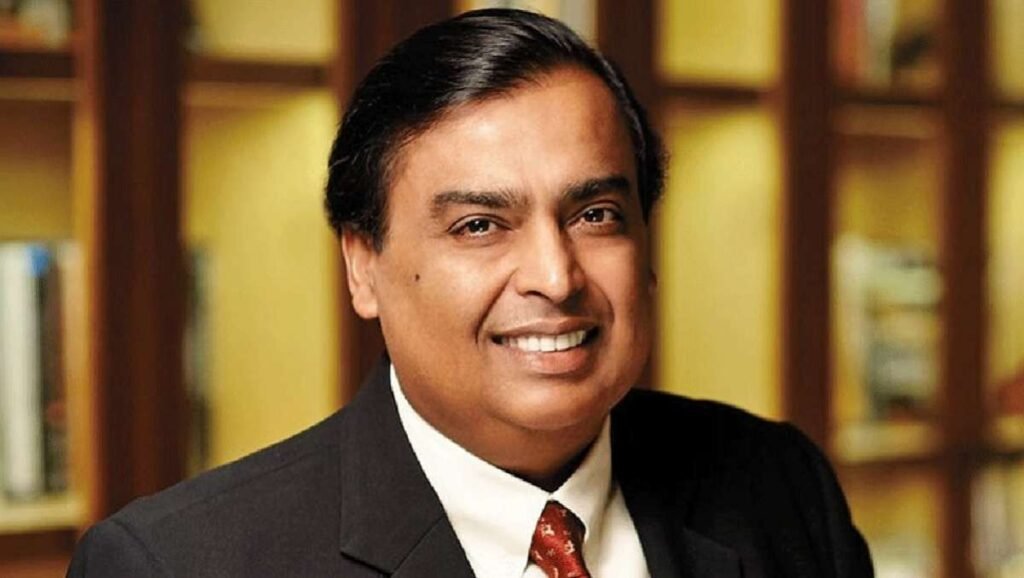

Comment from RIL Chairman

I am pleased to extend our relationship with General Atlantic as we work towards empowering both merchants and consumers alike, and ultimately transforming Indian Retail.

Like Reliance Retail, General Atlantic believes in the fundamental ability of digital enablement to drive progress, growth, and inclusion across India and the world.

We look forward to leveraging General Atlantic’s extensive expertise at the intersection of technology and consumer businesses, and two decades of experience investing in India, as we create a disruptive New Commerce platform to redefine retail in the country.

Comment from CEO of General Atlantic

General Atlantic is thrilled to be backing Mukesh’s New Commerce mission to drive substantial positive change in the country’s retail sector, which goes hand-in-hand with his vision to enable a Digital India through the work of Jio Platforms.

General Atlantic shares Reliance Industries’ foundational belief in the power of technology to foster transformative growth, and we are excited by the immense potential of the full Reliance ecosystem.

We are honored to again be partnering with the Reliance team to meaningfully accelerate India’s position in the global digital economy.”

Stock Market Impact

At 10:00 am, the shares of Reliance Industries were trading 0.27 percent higher at Rs 2,250.85 apiece on the BSE as against 0.35 percent loss in the Sensex.

The stock has gained as much as 161 percent since it 52-week low of Rs 867.82 hit on March 23.

Also Read:

Vedanta gets in-principle nod for delisting from BSE & NSE

Reliance Retail receives Rs 7,500 cr from Silver Lake for a 1.75% stake