Hyderabad-based Gland Pharma’s initial public offer (IPO) to raise up to Rs 6,480 crore is scheduled to open on Monday.

Gland Pharma IPO is the biggest initial public offering by a pharmaceutical firm in India.

About Company

Established in Hyderabad in 1978, Gland Pharma is an injectable-focused drugmaker with a footprint across 60 countries, including markets such as the U.S., Europe, Canada, Australia and India.

The company, which largely operates in the business-to-business segment, makes and markets complex injectables with drugmakers including Sagent Pharmaceuticals Inc and Apotex Inc.

The U.S. is Gland Pharma’s largest market contributing more than 60% to its sales.

About IPO

The IPO comprises issuance of fresh shares worth up to Rs 1,250 crore and an offer of sale (OFS) of up to 3,48,63,635 shares.

The OFS consists of sale of up to 1,93,68,686 shares by Fosun Pharma Industrial Pte Ltd

More 1,00,47,435 shares by Gland Celsus Bio Chemicals Pvt Ltd.

Another 35,73,014 shares by Empower Discretionary Trust.

And 18,74,500 shares by Nilay Discretionary Trust.

Subscription Date

The subscription will open from tomorrow i.e, 9th November till 11th November.

Price Band

The price band for the offer has been fixed at Rs 1,490 – 1,500 per share, and the issue will close on November 11

Face Value

The face value of the equity shares is Rs 1

Lot Size

The lot size is 10 which means that investors have to apply for multiples of 10 shares and in multiples thereafter.

Listing and Allotment dates

The shares are likely to list on BSE and NSE on November 20 and the IPO allotment is likely to be finalised around November 17

Shareholding Pattern

Fosun Singapore the subsidiary of Shanghai Fosun Pharma holds 74 per cent stake in the company.

Other investors of the company include Gland Celsus which owns 12.97 per cent while Empower Trust and Nilay Trust own 5.08 per cent and 2.42 per cent stake respectively.

Post IPO, the promoter shareholding will fall to 58% from 74%.

Intermediaries

Registrar

Link Intime India Pvt is the registrar of the issue and will manage allocation and refund.

Promoters

Fosun Pharma Industrial Pte. Ltd and Shanghai Fosun Pharmaceutical (Group) Co. Ltd is the company promoters.

Lead Managers

- Kotak Mahindra Capital Company Ltd

- Citigroup Global Markets India Pvt Ltd

- Haitong Securities India Pvt Ltd

- Nomura Financial Advisory and Securities (India) Pvt Ltd

Anchor Investors

Ahead of the IPO, Gland Pharma raised ₹1,944 crore from anchor investors at the price of ₹1,500 per equity share.

They are:

- Government of Singapore

- Nomura

- Goldman Sachs

- Morgan Stanley

- SBI Mutual Fund

- Axis Mutual Fund

- SBI Life Insurance Company

- Fidelity

- ICICI Prudential Mutual Fund

- HSBC Global Investment Funds

- Small Cap World Fund

- Many More

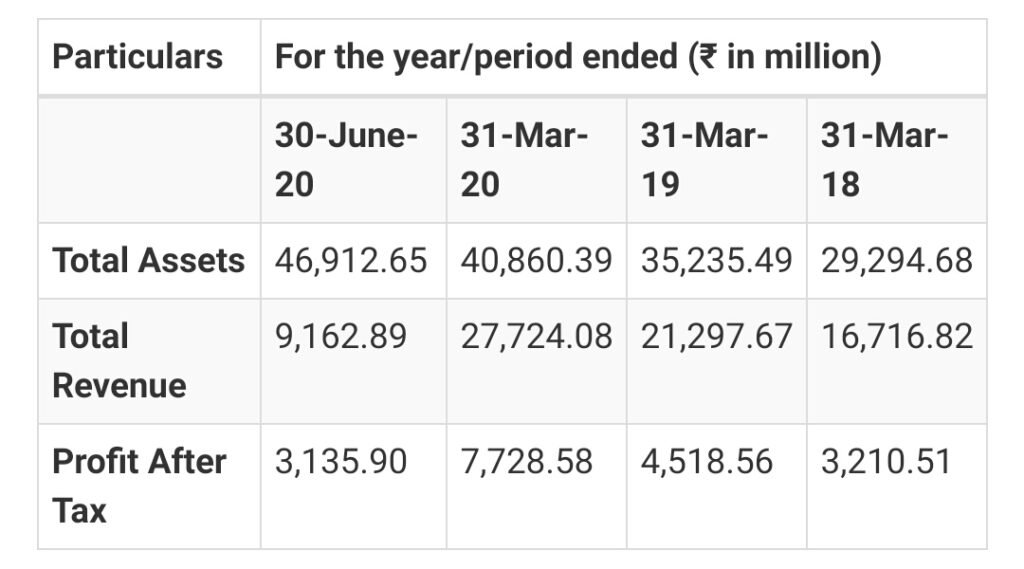

Company Financials

Objective of the IPO

The net proceeds from the IPO will be used for the following purposes:

- To finance the incremental working capital requirements of our Company

- To meet funding requirements for capital expenditure requirements

- To meet the general corporate purposes