The mortgage financier company ‘Home First Finance Company’ (HFFC) is all set to launch it’s IPO.

It will be the third IPO of 2021 after Indian Railway Finance Corporation (IRFC) which is currently open for public subscription, and Indigo Paints, which would be launched on January 20.

In the grey market, the scrip was commanding a premium of Rs 100 apiece.

About Company

Home First Finance Company is an affordable housing finance company.

The company primarily caters to the low and middle income groups by offering them housing loans to construct and buy homes.

It further offers other loans like loans against property, developer finance loans, and loans to buy commercial property.

It has a significant presence in the urbanized regions of Gujarat, Maharashtra, Karnataka and Tamil Nadu and has sanctioned over 50,000 home loans.

Important Dates

The IPO would be open for subscription on January 21 and close on January 25

The share allocation in Home First Finance is likely to be finalised on January 29 while listing is likely on February 3

Price Band

The company has fixed a price band of ₹517-518 a share for its initial share-sale with the face value of Rs 2 each.

Lot Size

Investors can bid for a minimum of 28 equity shares and and in multiples thereafter.

IPO Composition

The Rs 1,153.71-crore IPO, which will open on Thursday, comprises of a fresh issue of Rs 265 crore, and an offer for sale of Rs 888.72 crore by promoters and existing shareholders.

The offer for sale consists of Rs 435.61 crore worth of shares by promoter True North Fund V LLP, Rs 291.28 crore shares by promoter Aether (Mauritius), and Rs 120.46 crore by investor Bessemer India Capital Holdings II, Rs 28.43 crore by PS Jayakumar, and Rs 12.92 crore by Manoj Viswanathan.

Reservation Quota

Not more than 50 per cent of the issue will be reserved for Qualified Institutional Buyers (QIBs), 35 per cent for the retail category and 15 per cent for the non-institutional category.

Fund Utilisation

The net proceed from the issue will be used towards following purposes.

- To augment company’s capital base to meet future capital requirement.

- To achieve share listing benefits on the exchange.

Intermediaries

KFIN Technologies Private Limited is the registrar of Home First Finance IPO. It will manage share allocation and refund.

While Axis Capital Ltd, Credit Suisse Securities (India) Pvt Ltd, ICICI Securities Ltd, and Kotak Mahindra Capital Company Ltd are the book running lead managers to the issue.

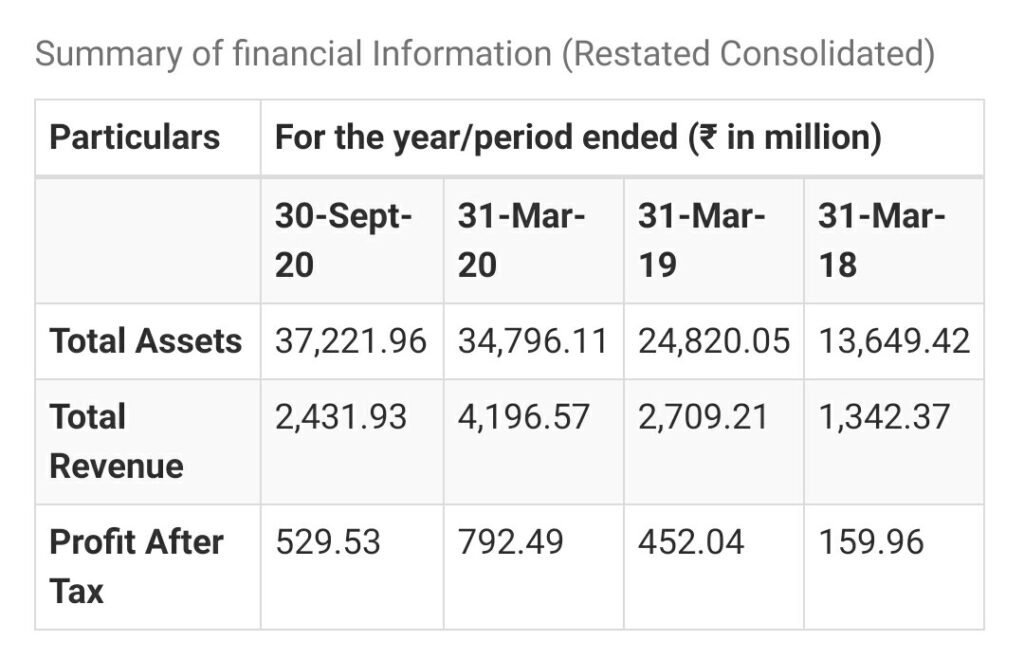

Company’s Financial

Press the Bell Icon for notifications of all updates