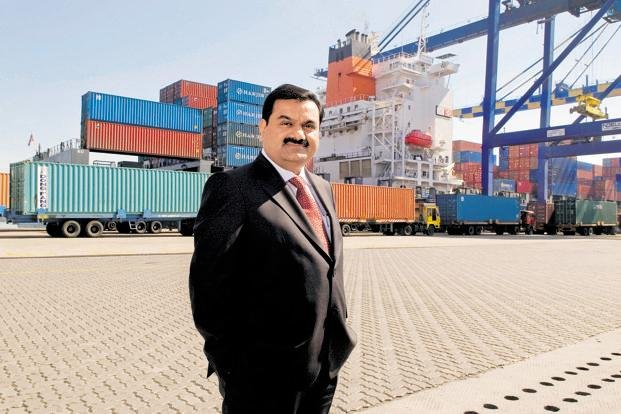

Iran-Israel war: In the wake of rising geo-political tension in the Middle Eastern countries after the outbreak of the Israel-Iran war, the business of some Indian companies may be affected if the war gets prolonged. Adani Ports and Special Economic Zone Ld is one of those Indian companies.

According to stock market experts, the flagship Adani group company has a high stake involved at Haifa Port in north Israel. They said that the Iran-Israel war has put instability in the Middle East region and it may affect Adani Ports’s business at the Haifa Port. They said that the war getting further prolonged may lead to affect operations of the Haifa Port in north Israel where Adani Ports has a major stake involved.

So, one should remain vigilant about the latest Middle East news, especially on the Iran-Israel conflict. They advised Adani Ports shareholders to maintain a strict stop loss at ₹1280 as the stock is trading in the ₹1280 to ₹1400 range.

Why Adani Ports stock is in focus?

Advising Adani Ports shareholders to remain vigilant about the developments in the Iran-Israel conflict, Amit Goel, Co-Founder and Chief Global Strategist at Pace 360 said, “Iran-Israel war would undoubtedly cause instability in the Middle East, and that could impact Adani Ports’ business at the Haifa port.

Its major concern is the security of Haifa port in northern Israel, where it has a major stake involved. War could lead to disruptions threatening the port’s operations. Shipping in the region could be disrupted due to increased military activity. This would make shipping routes less reliable and more expensive, potentially leading to a decline in cargo volumes at Haifa.”

However, the Pace 360 expert maintained that the Haifa Port contributes only about 3 percent of Adani Ports’ total cargo volume. So, the overall impact on Adani Ports’ business might be manageable and any dip in the stock should be seen as a buying opportunity by the bottom fishers.

Adani Ports share price outlook

Expecting upside in Adani Ports share price, Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher said, “Adani Ports share price has consistently remained above the 50-DEMA level of ₹1280 to ₹1285 levels.

I am expecting the stock to go up to ₹1390 to ₹1400 in the short term. On breaching above ₹1400 per share level on a closing basis, the Adani share may go up to ₹1490 to ₹1500 per share level in the short term. So, Adani Ports shareholders are advised to hold the scrip with strict stop loss at ₹1280 apiece.”

On the suggestion to fresh investors regarding Adani Ports share price, the Prabhudas Lilladher expert said, “Fresh investors can buy the scrip at current levels maintaining stop loss at ₹1280 for the short term target of ₹1400. They can hold Adani Ports shares for a further upside target of ₹1490 to ₹1500 if the stock sustains above ₹1280 and gives a breakout above ₹1400 on a closing basis.”

(Press the bell 🔔 Icon, for all latest updates)