NTPC Limited share price gained more than 4% on Monday to hit record highs of ₹358.30 on the NSE, during intraday trades. Notably NTPC stock was the largest gainer among Nifty-50 stocks.

As the power demand in the country remains strong and is lifting prospects of power producers like NTPC, the news flow around further capacity expansions remains strong, improving earnings prospects for NTPC and also investor confidence.

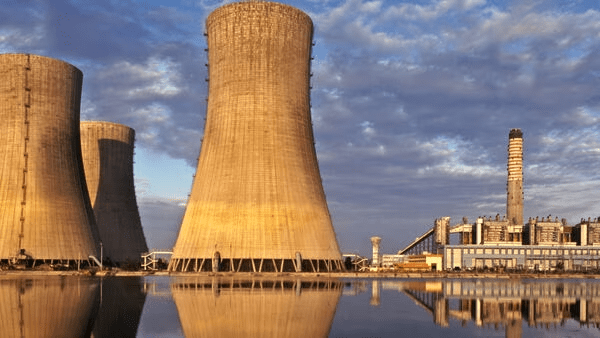

The Board of Directors of NTPC, in their meeting held on 3rd March 2024, have accorded investment approval for Singrauli Super Thermal Power Project, Stage-III (2×800 MW) at an appraised current estimated cost of Rs. 17,195.31 crore.

As the development bodes well for future capacities, NTPC group capacity has already crossed the 75 GW mark in March. ( One gigawatt (GW) = 1,000 megawatts or MWs)

NTPC, based on achievement of approved norms and due approvals, on 1st March had announced successful completion of trial operations at Unit-2 of 660 MW capacity of North Karanpura Super Thermal Power Project in Jharkhand. With this successful completion of trial operation, the project consequently got included in the installed capacity of NTPC .

The total installed capacity of NTPC on standalone basis thereby became 59298 MW and on group basis thereby had become 75418 MW.

NTPC has remained amongst top picks of analysts based on rise in capacities and strong power demand.

NTPC was amongst top picks of Jefferies India Pvt Ltd.

Analysts at Jefferies had said that “We estimate Power Capex CAGR will rise 9x at 20% in FY23-26 versus just 2.2% in FY10-20. As India enters a phase of capex-driven GDP growth, power intensity should rise. NTPC is a major beneficiary of the capex uptick.FY23-26 as per Jefferies, should see NTPC’s consolidated non-fossil portfolio rise 4.9x to 15 GW.

Jefferies estimates factor in 14 GW solar/wind Renewable energy by FY26 versus NTPC’s target of 15 GW.

Monetisation plans with stake sale/IPO over two to three years up as more assets come on the ground are an additional trigger ahead, Jefferies had said. Interest cost advantage gives room to bid 10-15% lower and earn same equity IRR (internal rate of return).

Jefferies Target price stood at Rs415 valuing the company at 2.3 times consolidated Price to Book FY26 estimates, in line with the average of the past upcycle.