Nvidia share price surged to an all-time high on Thursday with its market capitalisation witnessing the biggest single-session increase in history, topping Meta Platforms’ historic gain just three weeks ago.

Nvidia shares jumped 16%, adding about $277 billion in market capitalization and bringing its total market value near $2 trillion. The addition in market value eclipsed the $197 billion gain made by Facebook-parent Meta at the start of the month.

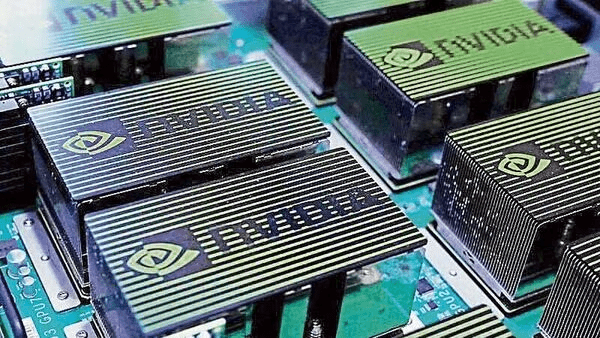

The shares of the chipmaker rallied after it reported blowout results that cemented Wall Street bets on the potential for its artificial intelligence technologies. The company’s guidance also beat Wall Street estimates, driven by AI spending at its biggest customers, including Microsoft Corp. and Meta.

A series of estimate-beating results means the shares have been getting cheaper on a price-to-earnings basis, Bloomberg reported.

Nvidia surpassed high expectations, according to Morgan Stanley analyst Joseph Moore.

“We had never seen $2 billion of upside to quarterly revenue guidance until Nvidia did it a few quarters ago, but it has become routine during the AI surge,” he wrote. “Strength of AI demand continues to be remarkable.”

Nvidia reported fourth-quarter revenue of $22.10 billion, up from $6.05 billion, and beating estimates of $20.62 billion. Adjusted for certain items, fourth-quarter earnings were $5.16 a share, compared with estimates of $4.64 a share, according to LSEG data.

Nvidia forecast first-quarter revenue growth of 233%, ahead of Wall Street expectations of 208% growth. The company forecast revenue for the current quarter of $24.0 billion, plus or minus 2%. Analysts on average were expecting revenue of $22.17 billion, according to LSEG data. It expects first-quarter adjusted gross margin to be 77%, plus or minus 50 basis points. Analysts on average forecast a gross margin of 75.6%.