This come after the the Reserve Bank of India (RBI) took a decision to launch a ‘positive pay system’ for cheque.

RBI advised Banks to build enough awareness among their customers on features of ‘Positive Pay System’.

What is Positive Pay System

A process of reconfirming important information of large value cheques is known as ‘Positive Pay System’.

Transaction limit

Under the new rule re-confirmation of key details may be needed for payments beyond ₹50,000.

The RBI has left it on the people as an optional to decide if they would want to avail this facility or not.

However, for cheques above Rs 5 lakh, banks may consider making it mandatory.

Effective date

This new cheque payment rule will come into effect from 1 January 2021.

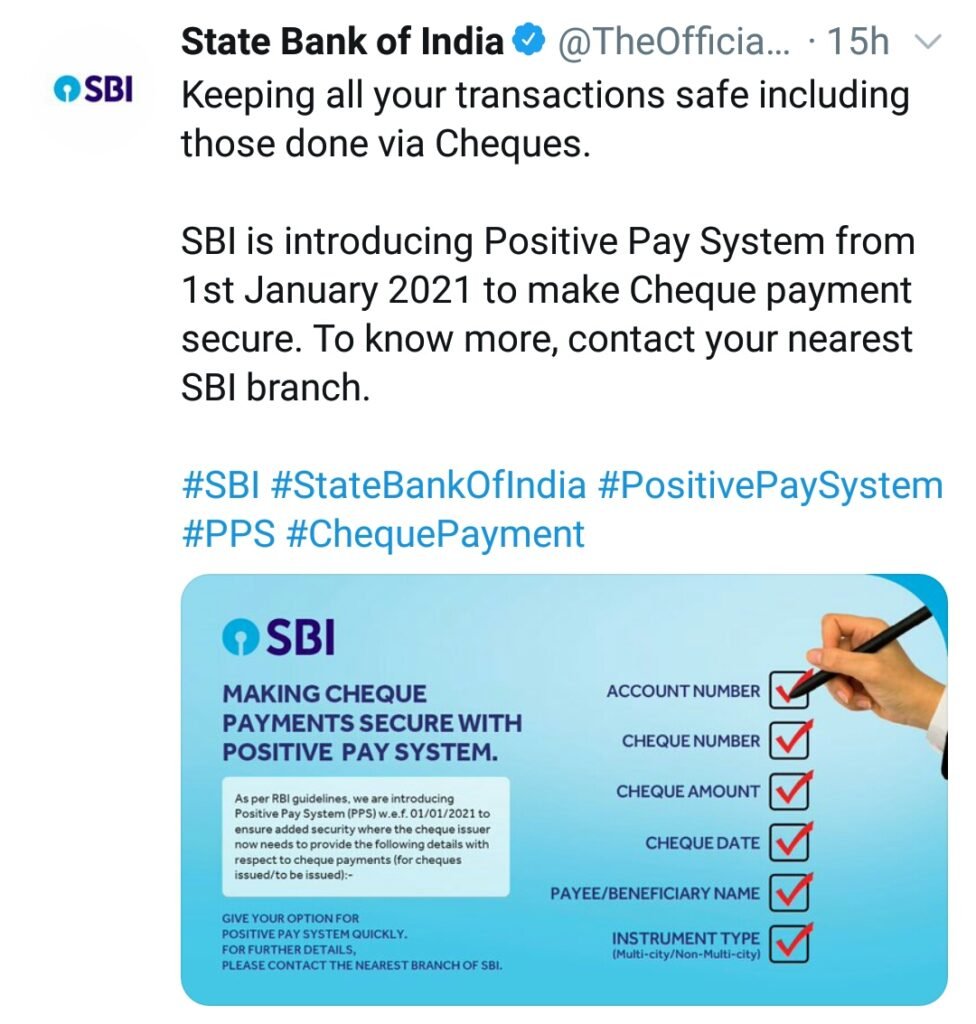

SBI updated on website

“As per RBI guidelines, we are introducing Positive Pay System (PPS) w.e.f. 01/01/2021 to ensure added security where the cheque issuer now needs to provide details such as account number, cheque number, cheque amount, cheque date payee name with respect to the cheque payments.”

SBI posted on Twitter

Press the Bell Icon for notifications of all updates