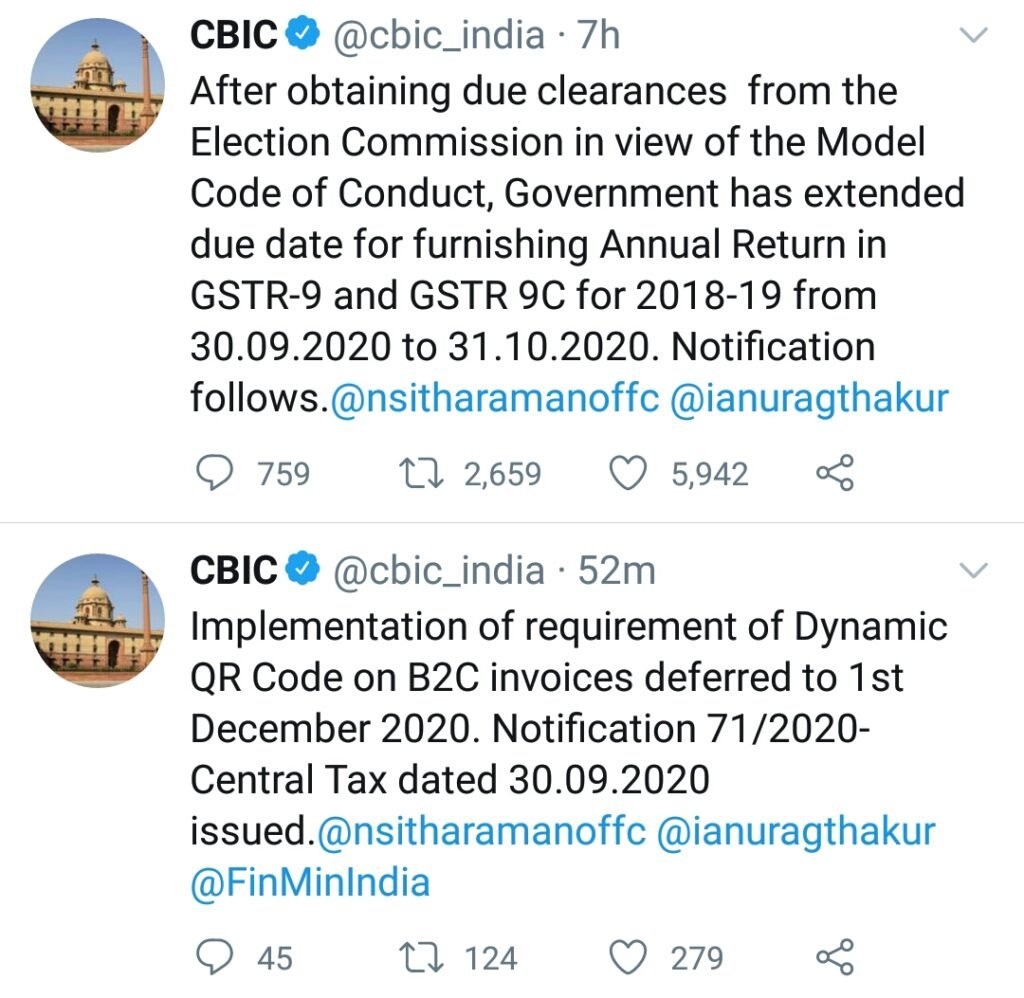

The Central Board of Indirect Taxes and Customs ( CBIC ) has extended the due date for filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for the Financial Year 2018 – 19 to be extended to 31st October 2020.

The move has been done after permission from the Election Commission (EC) as model code of conduct is in place due to the upcoming Bihar elections

The government in May had extended the last date for filing annual GST return for FY18-19 by three months till September 2020.

What is GSTR 9 ?

GSTR 9 is an annual return to be filed yearly by taxpayers registered under GST.

It consists of details regarding the outward and inward supplies made or received under different tax heads.

Basically, it is a consolidation of all the monthly/quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed in that year.

Though complex, this return helps in extensive reconciliation of data for 100% transparent disclosures.

What is GSTR-9C ?

The GSTR9C is an audit form that was introduced on September 13, 2018.

It must be filed annually by taxpayers with a turnover above 2 crores, and it must be certified by a CA.

It is basically a reconciliation statement between the annual returns filed in GSTR-9 and the taxpayer’s audited annual financial statements.

The form will contain the taxpayer’s gross and taxable turnover according to their accounting books, reconciled with the corresponding figures after consolidating all of their GST returns for the financial year.

What will be the Late Fees ?

The late fees for not filing the GSTR 9 within the due date is Rs 100 per day, per act.

That means late fees of Rs 100 under CGST & Rs 100 under SGST will be applicable in case of delay.

Thus, the total liability is Rs 200 per day of default.

However, there is no late fee on IGST yet.

Tweet of CBIC

Request from ICAI to GST council

Earlier in September, the Institute of Chartered Accountants of India (ICAI) wrote to the GST Council seeking deferment of 2018-19 GST annual return filing deadline by three months till December 31.